RFF Sees the Heat But Not the Blast

Did ancient Pompeii decline because of the heat? Well, yes, heat had much to do with its evisceration. But if you don’t consider the role of Vesuvius you wouldn’t appreciate what happened to Nero’s favorite metropolis.

That’s the problem we have with the findings of a report last week from Resources for the Future. In “Coal Demand, Market Forces and US Coal Mine Closures,” RFF analysts conclude that the sharp decline in domestic coal production from 2002 to 2012 was caused not primarily by low-as-a-snake natural gas prices or weak demand for electricity – let alone by regulations – but by coal’s high-cost of production.

The authors find that about two-thirds of coal mine closures were due to a doubling of costs-per-ton of coal mined since 2002 as mines aged and reserves were depleted. Natural gas and reduced power demand, they say, accounted for only a third of the decline. Although the fate of coal communities has received lots of attention, RFF insists “little is known about the recent causes of coal mining closures or about the effects of hypothetical future policies on the sector.”

Maybe “little is known” at RFF about what’s behind coal’s miseries, but those living closer to coal fields know a lot about it – and offer a far more convincing explanation for those rising production costs than the think tank’s.

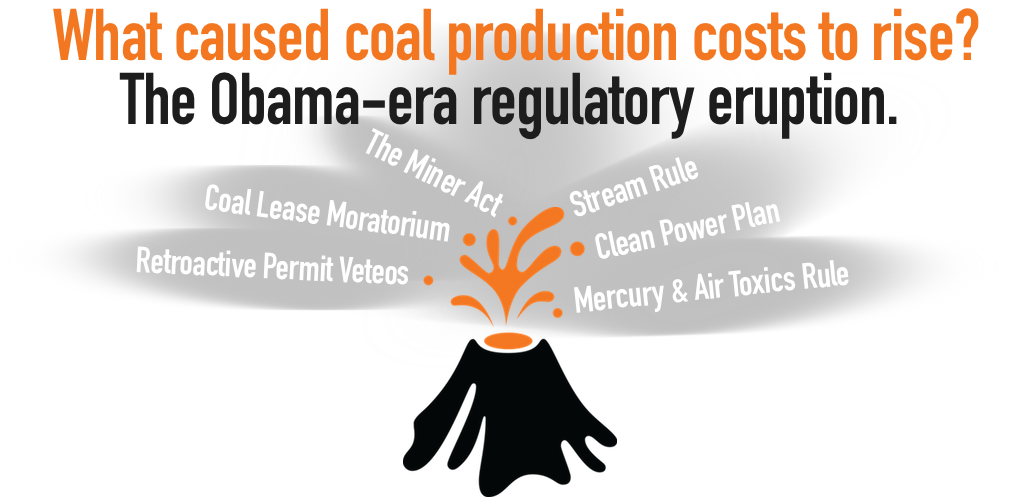

Start with the “volcano”: in this case, the Obama administration that for eight years erupted in regulations that engulfed coal communities. From the Mercury and Air Toxics rule in 2011 to the Clean Power Plan in 2014 and countless policies in between – including retroactive vetoes of mine permits, a federal coal lease moratorium, costly technology mandated by The Miner Act — regulations big and small raised coal’s costs. That’s often the point of regulation – it certainly was in this case.

Turning to our historical analogy, the heat that burned the coal industry may have been rising costs. But what caused those costs to rise? It was regulations from Washington that greatly contributed to the higher costs attributed to mining thinner seams in challenging geologic conditions.

Unlike Vesuvius, however, the destruction of coal fields was no accident; it was a deliberate result of federal policy. Destruction was the intention. “So if somebody wants to build a coal-powered plant, they can,” said President Obama. “It’s just that [a carbon price] will bankrupt them …” The bipartisan rejection of his cap and trade scheme led directly to the regulatory explosion from his agencies.

Not only did the ensuing regulatory standards favor gas over coal, the signal sent to investors was equally decisive. Unlike a gas plant that is relatively inexpensive to build (but costly to operate), a coal plant is a major financial commitment that requires a 15 to 20-year investment horizon.

If coal’s production costs have risen, so has its productivity – up by 26 percent over the past five years [EIA “Today in Energy” Mar. 7]. During the market bottom in 2016, 81 mines closed. Most were the least efficient, leaving the survivors better able to introduce new technology and process improvements. Point is, but for regulations, costs would have been lower and more mines would have survived.

Beltway reporters smitten by green think tanks nevertheless saw the RFF findings as casting doubt on the current administration’s attempt to resurrect coal. In fact, RFF’s emphasis on uncompetitive costs, if properly understood, suggests that the administration’s de-regulatory push is the right path toward stabilizing the industry.

- On April 11, 2018