Don’t Overlook the Value of Fuel Diversity

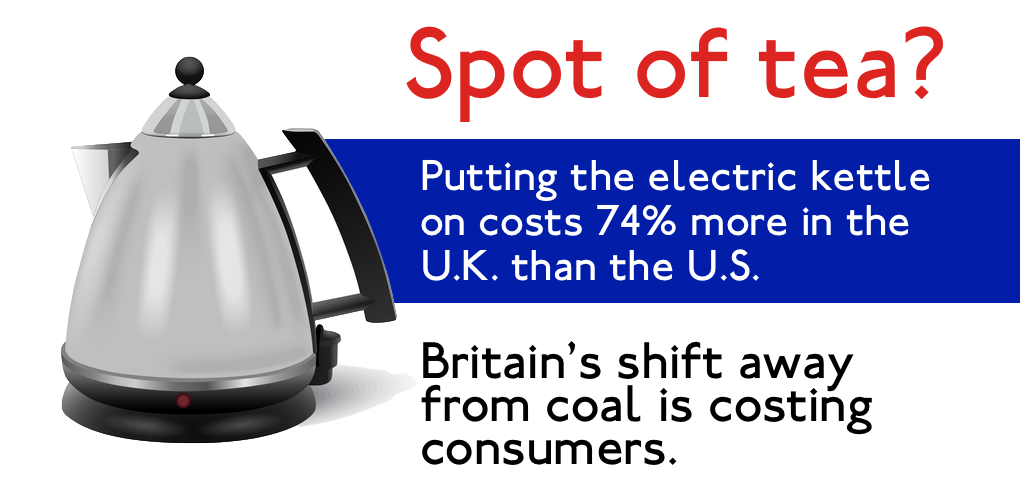

British environmentalists are in a tizzy. Despite heavy-handed government efforts to push coal off the UK’s grid, it is regaining market share and bringing much-needed relief to consumers who have dealt with household electricity costs 74 percent higher than here in the U.S.

Britain’s pivot away from coal to wind, solar and natural gas has run into a steep hurdle. Wholesale natural gas prices are now the most expensive they’ve been in a decade, up 40 percent since the start of the year. Biting carbon pricing aside, coal-powered electricity is too cheap not to run, and coal plants are humming again as natural gas units power down. Environmentalists see a problem in desperate need of fixing while grid managers and consumer advocates are reminded of the value of energy diversity. Without coal plants as an alternative fuel source, British consumers would be forced to shoulder the cost of ever-increasing natural gas prices with no hope of relief as winter looms and gas prices head further in the wrong direction.

This episode is a timely reminder that energy diversity – particularly of dispatchable fuel sources (those you can power up at the flick of a switch) – is the increasingly overlooked but deeply important element of a reliable and affordable supply of power. While electricity markets are supposed to protect consumers and encourage competition between energy sources, they are ill-equipped to reward balance and diversity in a fuel mix – especially when markets are being shaped not by free competition but an array of externalities, be they subsidies, crippling regulations or renewable portfolio standards.

What’s particularly troubling is that here in the U.S. grid operators believe their fuel mixes are more diverse or balanced than ever before when in fact just the opposite may be true. Growing contributions from wind and solar power, along with rapidly increasing reliance on natural gas, may make for wonderfully colorful resource mix pie charts and seemingly diverse supplies of power, but they are sowing dangerous complacency.

Wind and solar power are the tail that wags the dog. They can be awesomely productive and useful one minute and utterly useless the next when the weather won’t cooperate. And natural gas isn’t the panacea it might appear to be. While U.S. natural gas production has soared, and natural gas generating capacity has grown by leaps and bounds, the pipeline network to get natural gas where it’s needed hasn’t kept up.

Moreover, natural gas’ dance card is increasingly full. Not only is it used to generate the largest share of U.S. electricity, heat half of American homes and fuel a growing share of heavy industry but it’s also being exported in ever-increasing volumes. To be clear, there’s nothing wrong with any of this. Natural gas exports offer a range of benefits and gas generation is proving a valuable tool to balance the intermittency of renewable sources of power. But can we be certain today’s low natural gas prices, which are playing a central role in pushing so much valuable coal and nuclear capacity off the grid, are sure to last? It’s the million-dollar question.

All signs point to the continued rapid loss of dispatchable fuel diversity in the U.S., and that should terrify us. New nuclear and coal plants aren’t being built. In fact, nuclear and coal capacity is disappearing at an alarming rate. Our eggs are increasingly sitting in the natural gas basket. Look at the fuel mixes of New England and Florida as markers for this trend. Too many analysts and utility executives claim with certainty a future of continued low natural gas prices when time and again we are shown that the only certainty in the energy business is uncertainty.

In 2011, Clifford Krauss of the New York Times wrote of the first plans to re-engineer U.S. natural gas import terminals into export terminals. After years of volatile, yo-yo-ing natural gas prices, and the expectation that the U.S. was sure to become one of the world’s largest natural gas importers, the idea of exporting LNG seemed absurd. An energy expert told Krauss, “It is more likely to see snow in New York in July than to see exports of gas from LNG terminals in the U.S.”

Fast forward seven years, and not only are LNG exports happening, but they quadrupled last year. By 2020, the U.S. is expected to become the world’s third-largest LNG exporter. What the future holds for energy prices is anyone’s guess, and the best hedge against that uncertainty is fuel diversity.

- On September 20, 2018