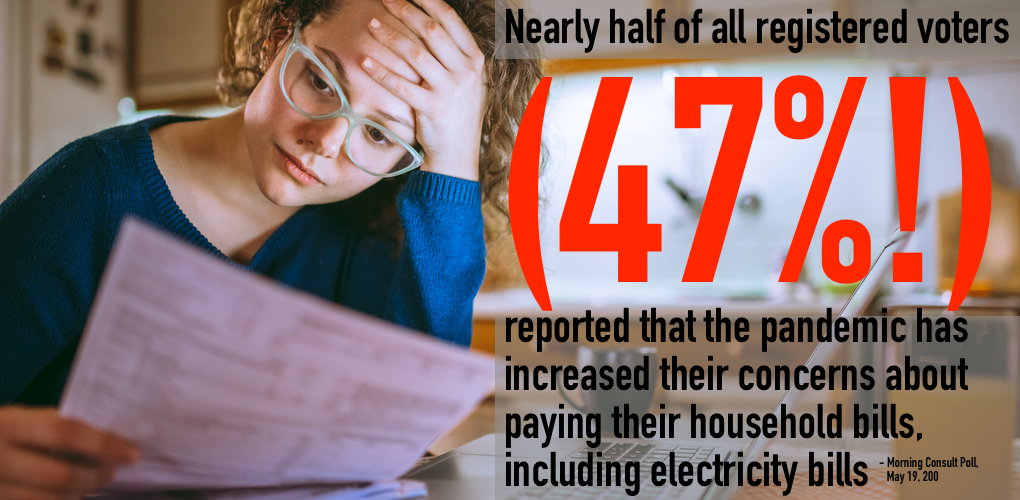

As the Pandemic Unfolds, Voter Concern Over the Affordability of Electricity is Surging

U.S. unemployment is flirting with 25 percent. As the country tries to weather the COVID-19 storm and look forward to reopening and recovery, economic pain is front and center for millions of families. It’s no surprise then that a new poll conducted by Morning Consult found that nearly half of all registered voters (47 percent) reported that the pandemic has increased their concerns about paying their household bills, including electricity bills.

That surge in concern should frame the way lawmakers, utilities and public service commissions think about energy in the months, and perhaps years, ahead. Voters want affordable and reliable power. Hard stop.

They don’t want new rate cases stemming from the premature retirement of well operating plants and the costs of paying for replacements. They don’t want surcharges for new infrastructure and they certainly don’t want spiking electricity prices during summer and winter months when staying cool or warm isn’t a luxury but a necessity.

This building concern over paying the bills also comes in what is likely still the early innings of the pandemic and recovery. The economic shock from the crisis may reverberate for some time, and as it continues, the concern over expenses could grow as well.

Rising electricity prices could not only derail any effort to bring vital industries and supply chains back home – an emerging policy priority – but handicap recovery for average Americans and small businesses alike. If Germany’s Energiewende is any preview for what to expect, perhaps it will be USA Today instead of Der Spiegel warning that electricity is becoming a luxury good.

Even before the pandemic and economic havoc, the Energy Information Administration warned that one in three American households already faced challenges affording their energy needs. A reeling economy and rising energy prices borne from misguided policy would be a cocktail the nation simply can’t handle.

The ongoing pivot away from a balanced, fuel-secure electricity mix to greater reliance on just-in-time fuel delivery and intermittent sources of power is already raising electricity prices, challenging reliability and imbedding unnecessary risk into the nation’s power system. Texas, of all places, is case in point.

The Ongoing Texas Reliability Two-Step

Summer after summer, the Electric Reliability Council of Texas (ERCOT), the state’s grid operator, has flirted with brownouts and record power demand that has threatened to overwhelm the grid. Last summer, on multiple occasions, demand did exceed supply and the system was forced into emergency operation. At one point, the price of electricity surged more than 49,000 percent and hit the market cap of $9,000 per megawatt hour. It was a roller coaster no one signed up to ride.

A year later, much remains the same. Despite the pandemic shaving some electricity demand, ERCOT again expects new record demand and the likelihood of emergency alerts begging consumers to turn off lights and dial back air conditioners. That is the optimistic scenario.

ERCOT’s reserve margin of generating capacity might be up this year, but Texas is relying more and more on wind and solar generation and its variability. The expanded reserve margin is in some ways an illusion. If the weather doesn’t cooperate, if the wind doesn’t blow on particularly stifling days, operating conditions could quickly deteriorate. On three key days last summer, that’s precisely what happened.

The grid operators are unphased, telling E&E News, “ERCOT has operational tools in place to maintain system reliability, including with large amounts of intermittent resources on the system. We use historical data to determine the capacity contribution of renewable resources during peak times.”

Historical data and models are well and good but commonsense says that as the percentage of variable power on the grid grows, so too will the risk.

Fortunately for Texans, the Gibbons Creek coal plant is coming back into service this summer to provide essential dispatchable power when it’s needed most. The plant was mothballed in 2018, but new owners are bringing it back online to help meet soaring summer demand. The plant’s return to service underscores two essential realities: Coal generation remains vital to grid reliability and, conversely, current market structure isn’t providing the right signals to keep essential plants like Gibbons Creek from being pushed off the grid in the first place.

If ERCOT’s dance with brownouts and price spikes is a preview of what could be coming for Americans across the country as the shift away from baseload power continues, it needs to be a stark warning. Reliability and affordability are what consumers expect, and they’re more important than ever in the shadow of an epidemic that has turned the economy upside down. Responsible energy policy that maintains a balanced, secure and affordable electricity mix should be priority one.

- On May 20, 2020