Looking Back as We Begin to Look Forward

The year is coming to a close, but before we look forward to 2022, it’s worth looking back on 2021 and the moments and themes that have shaped how we think about coal and its future. Over the course of 2021, this blog has tried to offer insight and perspective on an energy conversation that is as dynamic as ever. It’s a conversation with huge stakes that touch the hyper local – such as the mining communities of West Virginia and Wyoming that rely on the economic engine of coal production – and the global as policymakers and energy experts grapple with how the world can meet its voracious appetite for energy while advancing replicable solutions to reduce emissions. As we reflect, it’s worth highlighting a half-dozen posts that highlight the stories that defined the year and give us a sense of the themes that are likely to shape much of the conversation about coal in the year ahead.

1.7.21 ADDRESSING THE 95% CHALLENGE

With COP26 and deeply important climate provisions in both the infrastructure and reconciliation bills, climate and energy technology were the focus of much of what was covered on Count on Coal. Framing that conversation began with recognizing that over the next 80 years, the U.S. is going to account for just 5% of global emissions, and that U.S. technology leadership for the fuels the world leans on will be far more important than domestic emissions targets. We observed, “advanced technology solutions, with carbon capture at the top of the list, have become a place of bipartisan consensus on Capitol Hill for smart climate policy…. When we consider the 95% challenge, no policy may be more important.”

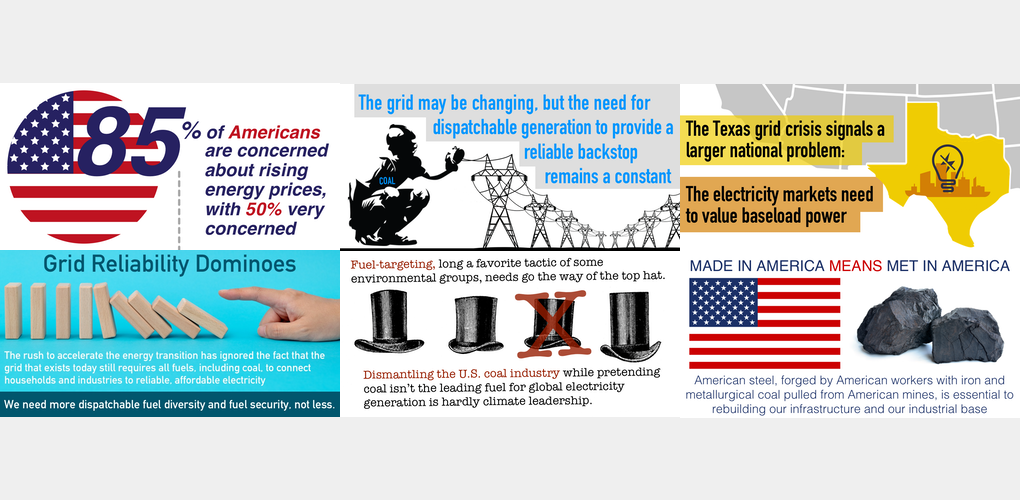

2.24.21 THE TEXAS GRID CRISIS IS A NATIONAL CRISIS

The Texas grid catastrophe was a defining and appalling moment for the ongoing debate about grid reliability during the energy transition. The Texas failure was a failure of markets, of planning and the slapped-together approach the nation seems to be taking to ensure the delivery of affordable, reliable power. We argued that we’re now in a dangerous energy no-man’s land, where the sources of energy that underpin reliability and affordability are being pushed aside. “Think the Texas electricity crisis can’t happen where you live? Think again. Up and down the country, electricity markets – with very different designs – have fielded warnings that the right storm, with the right conditions could cause the same chaos or worse.”

3.17.21 THE EXISTING COAL FLEET IS THE BRIDGE WE NEED

As more analysis shed light on the root causes of the Texas grid crisis, it became clear that the natural gas delivery system was the main point of failure, a particularly troubling development as reliance on natural gas has reached an all-time-high. In response, we argued, “Considering the value of dispatchable fuel diversity, and the obvious need for it, is existing coal capacity – not greater reliance on natural gas – the bridge we need to get where we are going? If certainty, fuel security and balance are what the bulk power system needs to navigate the transition – and they clearly are – the answer is an obvious one.”

8.4.21 INFRASTRUCTURE REINVESTMENT: AMERICAN MET FOR AMERICAN STEEL

Over the course of the year, we examined the importance of metallurgical coal to steel making and infrastructure reinvestment. And after years of waiting, infrastructure week finally became reality. We pointed out that the roads, bridges and countless energy components included in the U.S. infrastructure deal will need a tremendous amount of steel and met coal to help produce them. “With made-in-America a key focus of the infrastructure effort, the nation’s 175 met mines, directly employing 13,000 miners, are sure to be on the front lines of the great rebuild.”

9.29.21 DROPPING A BOMB ON ELECTRICITY AFFORDABILITY AND RELIABILITY

As Congress debated the merits of a potential Clean Electricity Standard (CES), two Federal Energy Regulatory Commission members offered startling testimony about how a potential CES could upend electricity markets, only exacerbating concerns over reliability and affordability. Their warning came just as Europe drifted into the beginning of an ongoing global energy crisis. Commissioner James Danly testified, “The bill as I read it seems to create an incentive and penalty structure that would absolutely change and frustrate every single expectation we have for [markets], effectively dropping an H bomb into the middle of them.” He later added, “Consequences will be profound, disruptive, and incalculable.”

10.20.21 SOARING ENERGY PRICES ARE THREATENING TO WRECK RECOVERY

Energy-driven inflation and the pain its causing consumers has come to dominate the news cycle and dictate policy. In early October, citing polling from Morning Consult, we found that 85% of Americans were concerned about rising energy prices, with 50% very concerned. We observed, “There’s no debate that the global energy crisis and its inflationary pressure have arrived in the U.S. Inflation is here and energy is the driver…. Soaring energy prices are exactly what the economy and American workers simply can’t afford as the nation attempts recovery. Yet, energy-induced inflation is likely to get worse before it gets better.” That has certainly been the case, and it’s clearer than ever that the optionality provided by the coal fleet to shield consumers from volatile natural gas prices is a pillar of our energy system we can’t afford to lose.

- On December 15, 2021