Where is the Power Going to Come From?

It is becoming inarguably clear the U.S. is in for a surge in electricity demand. The Biden EPA just finalized its tailpipe rule and by 2032, 70% of new cars will run primarily on electricity. New semiconductor and battery manufacturing plants are connecting to the grid with power demands that rival small cities. Add in AI and the explosive growth of data centers and we’re jumping from an era of flat power demand to one with breakneck growth overnight.

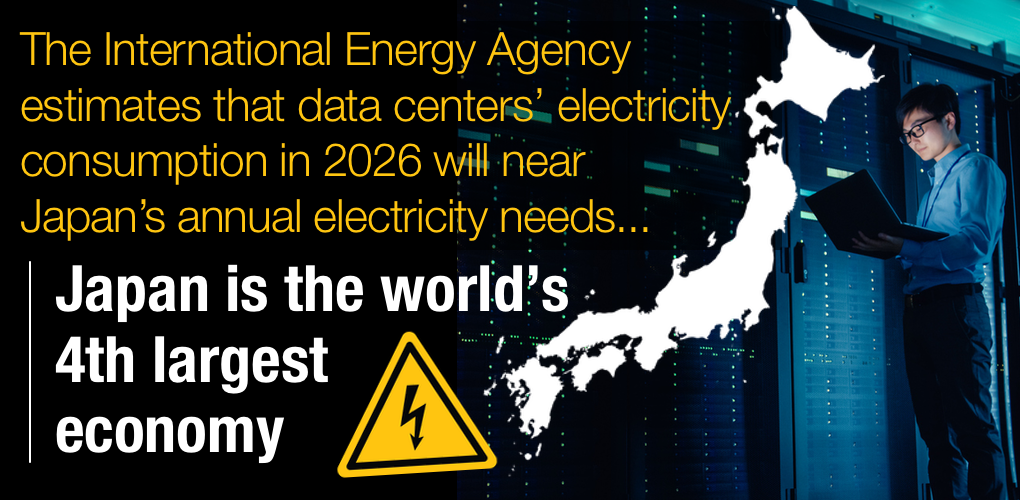

The world is now adding a new data center every three days. The International Energy Agency estimates that data centers’ electricity consumption in 2026 will near Japan’s annual electricity needs, the world’s 4th largest economy.

There is consensus that we’re going to need a lot more power; what is far less clear is where it’s going to come from.

While The Washinton Post, The New York Times and The Wall Street Journal have all recently put a spotlight on surging demand and a projected shortfall in power supply, little attention has been given to the other elephant in the room: the accelerating loss of existing baseload generation, namely the nation’s coal fleet.

If it seems paradoxical that the administration is pushing for the premature closure of well operating coal power plants that can meet the needs of tens-of-millions of homes while power demand surges, you will get no argument here.

In PJM alone – the nation’s largest electricity market serving 65 million people – the grid operator’s independent watchdog is warning the market could lose 58 GW of dispatchable power by 2030, enough generating capacity to serve 40 million homes.

Regulatory Pressure and Market Failure

EPA’s regulatory onslaught and state clean energy mandates are driving retirements, but something also seems to be very, very wrong in electricity markets.

While demand surges – and capacity reserve margins fall – prices aren’t reflecting a rapidly approaching power deficit. In short, when we know we need far more power and far larger reserve margins to meet winter and summer peak demand, market signals are instead pushing critically important plants into early retirement.

“We know that there is a looming resource adequacy crisis… Were any more proof required of our markets’ failure, in the midst of PJM’s dire warnings, somehow the prices in its procurement auction, at a time of impending scarcity, went down,” James Danly, former member of the Federal Energy Regulatory Commission (FERC), told the Senate Committee and Energy and Natural Resources last year.

FERC commissioner Mark Christie echoed that warning, saying, “The capacity markets are not all right. There are fundamental problems specifically in the multi-state capacity markets — ISO New England, [the Midcontinent Independent System Operator] and PJM — that are directly leading to serious reliability problems.”

And as much as the Biden administration wants to believe otherwise, additions of renewable power aren’t going to get the job done. Not only can intermittent renewables not provide the dispatchable capacity needed for peak demand, it’s becoming increasingly clear renewables and their enabling transmission infrastructure aren’t going to be able to scale at the speed boosters hope.

“We’re not going to build 100 gigawatts of new renewables in a few years. You’re kind of stuck,” former U.S. Energy Secretary Ernest Moniz toldThe Wall Street Journal. He said utilities will likely lean on existing capacity, and perhaps support the construction of new gas plants to keep up. The gas industry certainly hopes so.

Ryan Lance, CEO of ConocoPhillips toldPolitico, “I predict in the next five, 10 years that we’ll be building more gas-fired power generation in the U.S. more than anybody else in the world. We’re gonna need it in order to solve this energy problem.”

Here’s an alternative idea. Instead of asking more of a natural gas system that already can’t keep up – that has proven to be a reliability liability – let’s take the regulatory foot off the coal fleet’s neck.

If rationality can return to energy markets, and surging power demand may force the issue, using the existing coal fleet as a reliability bridge simply makes sense. Meeting surging demand over the next decade will be a far lower hill to climb if we simply lean on the generating capacity we already have.

- On March 27, 2024