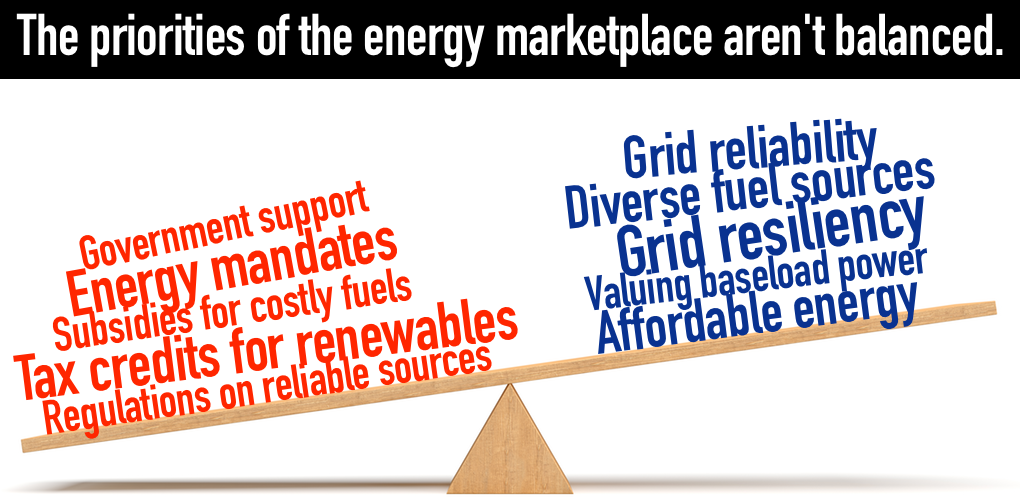

Rebalance the Electricity Marketplace

For those opposed to government intervention to ensure grid reliability, the rallying cry has sounded something like: “How dare you interfere in the free market?”

What free energy market are these critics talking about?

As Hollman Jenkins Jr. recently observed in The Wall Street Journal, “Energy decisions are already highly politicized.” He continues, “That’s the problem, especially the mandates in many states to keep ratcheting up the share supplied by intermittent power sources.”

The idea that coal or nuclear power plants have competed in anything close to a fair and free market is laughable. The electricity marketplace as it exists today has been shaped by a mix of overzealous regulation and enormous subsidies and mandates for renewable energy sources. The numbers speak for themselves: 29 states covering 56 percent of the nation’s electricity sales have renewable energy portfolio standards. The Renewable Electricity Production Tax Credit, implemented in 1992, has relentlessly pumped tens of billions of dollars into wind and solar projects.

While coal generation has been saddled with crippling regulations, such as the Mercury and Air Toxics Standards or the Clean Power Plan – both carefully designed to inflict damage on the coal industry – renewable sources of energy have been juiced with billions in government largesse.

Just how much? Consider that in 2016, according to the Congressional Research Service, renewable sources of power received $11.4 billion in subsidies, a staggering 63 percent of total tax-related support for energy sources that accounted for just 12 percent of U.S. energy production.

Have these mandates and subsidies influenced the marketplace? The answer is a resounding yes, and there’s no better proof point than NextEra Energy.

As The Wall Street Journal’s Russell Gold reported, NextEra has simply played the mandate and subsidy game better than anyone else. They have built a business model on it. Gold describes NextEra as “relentlessly capitalizing on government support for renewable energy.” Of the $4.8 billion in renewable-energy tax credits the U.S. government expects power companies to generate this year, NextEra is positioned to generate the largest share of them.

How profitable has NextEra’s subsidy-chasing approach been? In 2001, the company, then called Florida Power & Light, was the 30th largest U.S. power company with a market capitalization of $10.2 billion. Today, NextEra has a market cap of $74 billion and is the nation’s most valuable power company.

Coal and nuclear power plants pushed into early retirement aren’t victims of a free market, they’ve lost in a race that was carefully designed to ensure they couldn’t win.

For nearly 30 years the government has incentivized the addition of intermittent sources of power. Through the eyes of a green-energy evangelist, those efforts have succeeded beautifully, but they have also come to undermine our grid.

As Secretary Perry and the U.S. Department of Energy have observed, we have shaped a marketplace that is exchanging reliable, fuel-secure sources of energy for less reliable, more vulnerable alternatives. If you’re a renewable energy developer, the market is working just as intended. And that’s the problem.

We are teetering on a reliability and resiliency tipping point of no return. Since 2010, power companies have retired or announced intent to retire, 115,000 MW of coal capacity. Half of the nation’s nuclear fleet is facing significant economic pressure. The administration is right to act to return balance to the electricity marketplace and ensure our baseload power plants – our most reliable and resilient sources of energy – are adequately valued.

- On June 27, 2018