Educated in New England

New England: great schools, lovely foliage, terrible energy policy. New England’s self-imposed energy woes should be a warning to the rest of the country. Are we paying attention?

New England is an energy-intensive place to live (the winters are no joke), and energy bills show it. Poor policy choices have burdened consumers with some of the nation’s highest energy prices to compound the burden of high energy use. Those same poor choices, which have eroded the region’s energy diversity, have the regional grid operator, ISO New England, now questioning the reliability of the grid.

Populist environmentalism has run roughshod over practicality. New England has become ground zero for activist-driven NIMBYISM, and the region’s rate payers are literally paying the price.

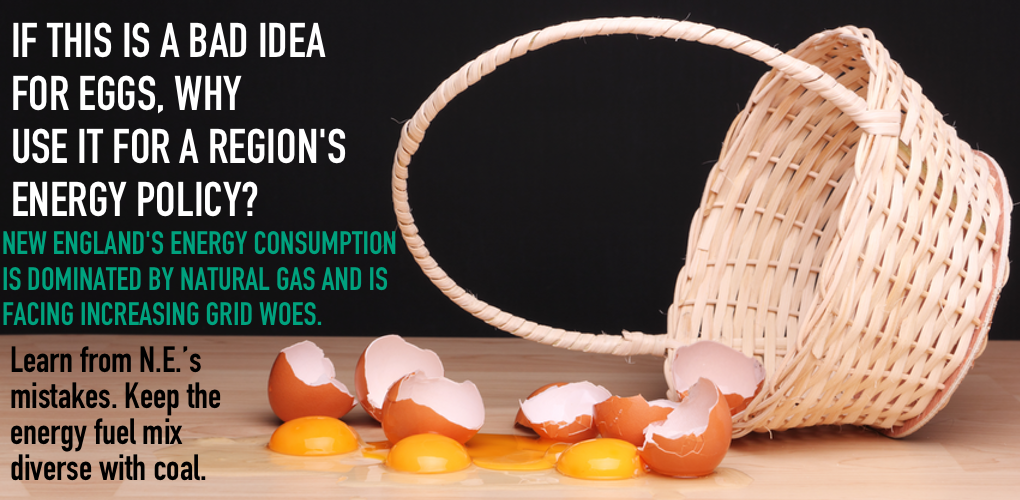

While the fight over new natural gas pipeline capacity going into and through New England has captured headlines over the past few years, it’s the choices that have necessitated this fight that deserve more attention. New England’s energy consumption is ever more dominated by natural gas. Natural gas is used to generate half the region’s electricity, and it’s also the dominant fuel for home heating. The region’s eggs are increasingly in the natural gas basket, a prickly place to be when periods of peak demand – those brutal cold snaps – push fuel security to the edge and energy prices through the roof.

ISO New England has warned that there is a growing likelihood of inadequate fuel supplies by 2024-2025. They have pointed to a lack of energy infrastructure as a challenge but also the threat of further power plant retirements.

Coal generation, once a cog of New England’s energy infrastructure, is now gone. In 2000, coal accounted for nearly 20 percent of the region’s electricity generation while natural gas accounted for about 15 percent. The loss of nearly all that coal capacity along with a growing number of nuclear plant retirements is becoming an increasingly difficult problem to manage. As we are often reminded, fuel diversity matters. ISO New England is certainly beating that drum.

When bitter cold descends, ISO New England has been able to shift electricity demand onto coal and oil-fueled power plants that are now in shorter and shorter supply. For example, while natural gas typically supplies half or more of the region’s electricity, during a cold snap in February 2015, it met just 25 percent of demand while coal and oil met 30 percent. A balanced, diverse grid not only helps keep energy prices in check but it can mean the difference between keeping the lights on.

During the cold snap at the end of December and early January of this year, natural gas met just 18 percent of the region’s electricity demand. And, some of that natural gas had to be brought in by LNG tanker from Russia. With more power plant retirements coming, New England is sticking its foot further into the vise.

Peter Brandien, vice president of system operations for ISO New England, told the audience at a recent FERC conference that “the most pressing challenges to the resilience of the power system do not relate to transmission, but to the possibility that the region’s generating fleet will not have, or be able to maintain the fuel they need to produce the power to meet system demand and maintain required reserves.”

What’s particularly troubling is that the market has created this predicament. Market signals have pushed merchant producers to close needed power capacity, continuing the erosion of the region’s fuel diversity. While ISO New England is working to institute pay-for-performance capacity market incentives to address market flaws, it might be too little too late. With so much baseload capacity and fuel diversity already gone, and more retirements scheduled, the situation in New England is poised to get worse before it gets better.

Other power markets must learn from New England’s missteps. Years of heavy-handed regulation, billions upon billions of dollars in subsidies for renewable sources of power as well as renewable portfolio standards have wreaked havoc on electricity markets. The loss of fuel-secure, baseload sources of power, and their replacement by less reliable alternatives, is a net loss for consumers. The cost of failing to address market flaws and preserving our energy diversity will be far higher than continuing with the status quo. Just ask New England’s ratepayers.

- On August 1, 2018