A Roll of the Dice

Jerry Jones, the enigmatic, billionaire, oil-man owner of the Dallas Cowboys just made a big bet on the future of natural gas. His gamble is a timely reminder that low prices and cheap energy don’t tend to stay that way. Predicting just when natural gas prices rise is anyone’s guess, but Jerry is rolling the dice and American consumers better hope he’s wrong.

Natural gas prices have stayed stubbornly low since the emergence of the shale revolution a decade ago, but low prices have generated ever-building demand that could soon catch up to the glut. Jones said he sees an opportunity not unlike his $140 million purchase of the Cowboys 30 years ago. That bet turned out pretty well – the team is now worth about $5 billion and is the NFL’s most valuable franchise.

If Jerry proves right, and natural gas prices begin to tick up, Americans are bound for a demonstration of the value of a balanced electricity mix. It’s only through a balanced, diversified portfolio of electricity generating sources that consumers are protected from fuel price volatility. Historically, as the price of one fuel would rise another could offset it. The balance in fuels provided cushion to protect consumers from the kind of surges in energy prices many might equate with a spike in oil prices that bears poison fruit at the gas pump.

An IHS Markit study from 2017 found that the nation’s diverse fuel mix lowers the cost of electricity by about $114 billion per year and reduces the variability of monthly consumer electricity bills by around 22 percent. The lead author of that study wrote, “It is easy to take the cost-effective diversity of the current U.S. electric supply portfolio for granted.” Of course, that’s precisely what has happened. As baseload coal and nuclear power plant retirements have accelerated and as our overreliance on natural gas and its constrained, just-in-time fuel delivery system grows, the potential pain from a fuel price increase – the very price increase Jerry Jones is betting on – is growing in tandem.

The Illusion of Balance

It’s easy to mistakenly believe the grid still possesses the fuel diversity and balance that has for so long been such a strength. The U.S. Energy Information Administration (EIA) reports that in 2018 natural gas was used to generate about 35.1% of the nation’s power, coal 27.4% and nuclear energy 19.3%. These three dispatchable fuel sources carry the lion’s share of the nation’s electricity burden, but these numbers hardly tell the complete story.

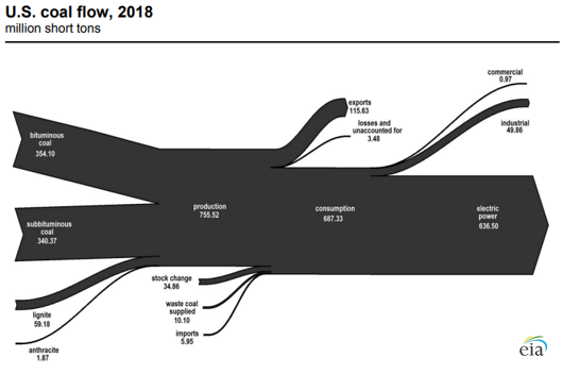

While coal and nuclear power are used almost exclusively to generate electricity, natural gas is not. Consider the following chart from the EIA on the nation’s coal production and consumption.

Of the more than 755 million short tons (MMst) of coal produced in the United States, the electric power sector consumed 636 MMst or 93% of domestic coal consumption. Coal is a fuel primarily dedicated to power production with little if any historical price volatility. The same chart for natural gas tells a very different story.

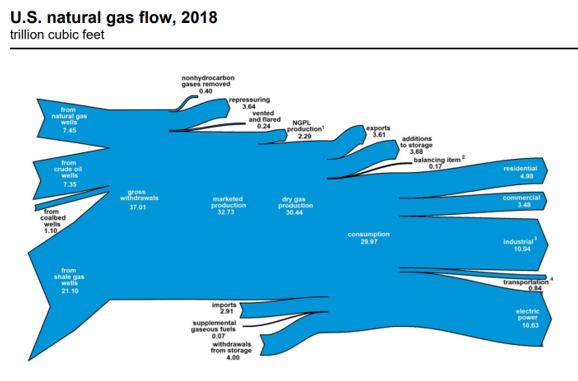

Natural gas is pulled in five different directions in large volumes. While the most significant use of natural gas is for electricity generation, demand from the industrial sector, from heating and increasingly from exports is applying growing pressure as well.

While natural gas production is responsive to the market, years of low prices have created a backlog of new demand just beginning to kick into full swing. The American Chemistry Council announced that through the close of 2018, petrochemical producers had invested more than $200 billion in more than 300 projects to take advantage of low-cost gas. Since 2015, more than 30 GW of new combined cycle natural gas generating capacity has been added to the electricity grid. On top of this surge in demand from these two sectors comes natural gas exports, both by pipeline and by LNG tanker.

As recently as 2010, U.S. pipeline exports to Mexico averaged just 0.8 Bcf/d. By next year, they’re expected to jump to more than 6.2 Bcf/d – a nearly 700% increase. U.S. LNG exports are on the same growth trajectory.

The very first LNG export terminal entered service in 2016 and three more have followed. By the end of next year, U.S. LNG export capacity will reach 9 Bcf/d. Additional capacity and additional exports are in tow. Voracious global appetite for U.S. LNG, particularly in Asia, is driving a rapid expansion of the industry. While exports are generating considerable economic benefits in the U.S., and should be encouraged, increased global demand will start to apply pressure to domestic natural gas prices. Just last year, the U.S. Commodity Futures Trading Commission reported that “increasing exports of LNG from the U.S. may mean that the domestic market will be influenced more by global forces.” They continued, “given the magnitude of U.S. exports, there is also the potential that domestic natural gas markets could become subject to global supply-demand dynamics with the potential for increased volatility.”

Counting on the price of natural gas to stay low might well be in an exercise in wishful thinking. Jerry Jones, and other savvy investors, are certainly betting it won’t.

Whether the price of natural gas rises or not is a moot point. Preparing for uncertainty is essential to energy security. Maintaining a balanced mix of energy sources to provide the optionality to shield our economy from energy price spikes is critical. But, until we start valuing balance in our electricity markets, the loss of essential baseload coal and nuclear capacity will continue and so too will our exposure to the full pain of renewed natural gas price volatility.

- On June 12, 2019